The Major Texas Health Insurance Carriers

In Texas, several carriers offer health plans both on and off the Health Insurance Marketplace.

We have a massive guide on how to compare the Texas exchange carriers but let's view the general landscape.

These companies vary in terms of network size, customer service, and plan options.

Here's a quick look at some of the major players:

1. Blue Cross Blue Shield of Texas (BCBSTX)

See BCBS of Texas review.- One of the largest and most recognized health insurance carriers in Texas.

- Offers a wide range of plans, from Health Maintenance Organization (HMO) to Preferred Provider Organization (PPO) options (employer), Medicare Supplements, and Advantage/Part D.

- Known for its extensive provider network, which includes most doctors and hospitals across the state.

- Popular for both individual, medicare, and small business plans.

- Available on-exchange with subsidies.

See head to head comparison (it is the major carrier after all!):

- BCBS of Tx versus United probably the big battle going forward

- BCBS of Texas versus Oscar really an HMO versus EPO battle

- BCBS of Texas versus Ambetter same with the EPO network angle

- BCBS of Texas versus Scott and White

2. Ambetter from Superior HealthPlan

Ambetter Exchange Guide and Review for Texas- Focuses on affordable, quality healthcare for Texans.

- Primarily offers HMO plans, which can help keep costs low for members.

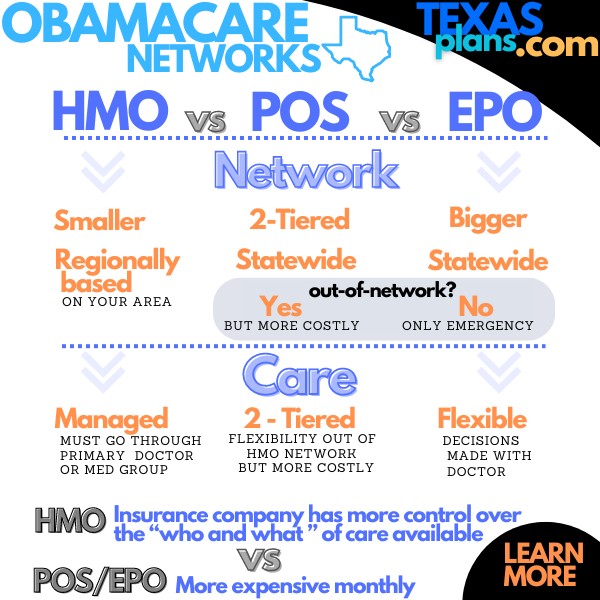

- EPO option for more flexibility and control versus the HMO (see Exchange Texas networks)

- A good choice for those who qualify for subsidies and are looking for lower-cost premiums.

3. Cigna

- Offers both HMO and EPO (Exclusive Provider Organization) plans.

- Known for its customer service and digital tools, making it easy for members to manage their coverage.

- While its network isn't as large as BCBSTX, Cigna offers competitive pricing, especially in major cities.

4. Molina Healthcare

- Known for serving low-income families and individuals.

- Molina specializes in HMO plans with affordable premiums, especially for those who qualify for subsidies on the Marketplace.

- The network is more limited, so it's important to make sure your doctors are covered.

5. Oscar Health

- A newer player in the Texas market, known for tech-savvy solutions and easy-to-use mobile apps.

- Primarily offers EPO plans with competitive pricing for individual and family plans.

- Best for those who prefer managing their healthcare online and are comfortable with digital tools.

6. United Healthcarecare

- Another big name in the Texas market, known for its networks - we expect United to be a big competitor with BCBS over the next few years.

- Great for individuals or families who want more provider options and are willing to pay slightly higher premiums for that flexibility.

- Also offers strong Medicare and employer-based plans.

Big guide on United Healthcare of Texas Obamacare Reviews

How to Choose the Right Health Insurance Carrier

Choosing a health insurance carrier is about more than just picking a company with a recognizable name.

You'll want to look at factors that matter most to your unique situation, like network size, plan options, and cost.

1. Network Size

Big review on how to compare the Texas obamacare networks since they're so different!

Do you have specific doctors or hospitals that you prefer?

If so, you'll want to make sure those providers are included in the carrier's network.

Some carriers, like Blue Cross Blue Shield, have a large network across the state, while others, like Ambetter or Molina, may have more limited networks.

We make this super easy. When you run your quote, you

can enter your doctors or hospitals directly through the quote here:

2. Plan Types

Different carriers offer different types of plans, including HMO, PPO, and EPO options depending on the market.

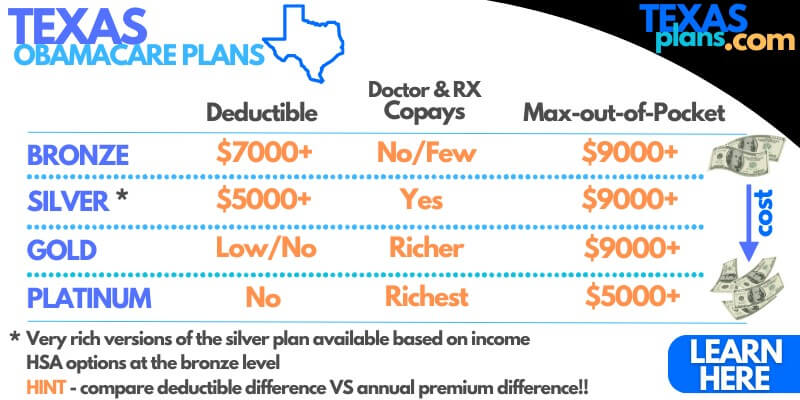

The plans for the individual market are standardized now and here are the benchmark plans:

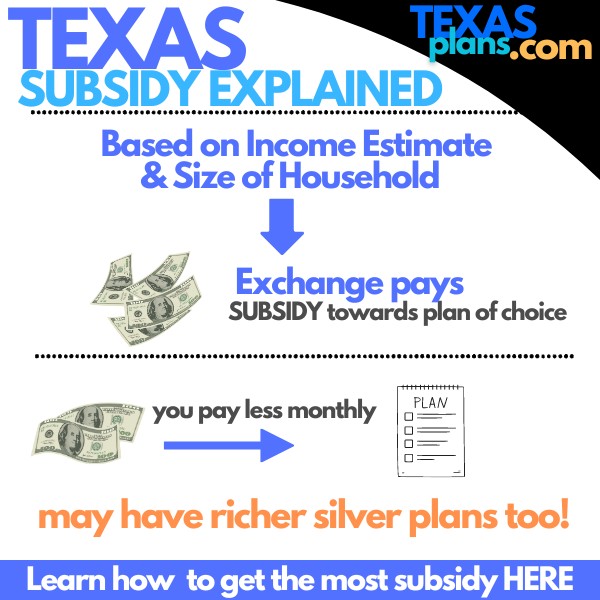

This gets confusing so let us do the heavy lifting but the real star of the show now revolves around subsidies!

33. Premiums and Costs

We can now get subsidies to bring down the cost of coverage based on income and it can mean $1000/year in savings.

And how much are you comfortable paying out-of-pocket if you need care? Learn more about how to compare the different plans.

Keep in mind that plans with lower premiums usually come with higher deductibles and copays.

4. Customer Service

Some carriers, like Cigna and Oscar, are known for their excellent customer service and easy-to-use online tools.

All the carriers though have upped their online enrollment portals to match this. Some carriers are just easier to deal with but lean on us with issues as well!

If managing your insurance online or having a responsive customer service team is important to you, this is something to keep in mind when choosing your carrier.

Want a Deeper Dive into Comparing Carriers?

CChoosing the right carrier is about balancing your needs, your budget, and the available options. We've put together a helpful guide to make it even easier for you. Check out our Texas Health Insurance Carrier Comparison Guide for a deeper look at each carrier's strengths, plan types, and coverage options.

This guide will walk you through:

- How to evaluate each carrier based on your personal needs./li>

- Key factors like plan types, pricing, and provider networks.

- The pros and cons of each carrier to help you make the most informed decision possible.

Navigating the Marketplace and Off-Exchange Options

Marketplace Plans (Exchange, ACA, obamacare...all the same thing!)

These are health plans available through the Texas Exchange.

If you qualify for a subsidy based on your income, you'll only be able to use it on these plans. Major carriers like Blue Cross Blue Shield, Ambetter, and Molina offer plans on the marketplace.

Run quotes for the full exchange range of options here:

Final Thoughts

The Texas health insurance landscape is diverse, with multiple carriers offering plans that cater to different needs, budgets, and healthcare preferences.

Whether you're looking for a low-cost HMO plan, a flexible EPO/PPO, or an affordable marketplace option, understanding the major carriers and their offerings will help you make the best decision for you and your family.

Ready to start comparing plans? Be sure to check out our Texas Health Insurance Carrier Comparison Guide for a full breakdown of what each carrier offers, and find the plan that's right for you.

Still have questions? We're here to help. Get in touch with one of our licensed agents to get personalized guidance and support every step of the way.